Create a realistic operating budget at the start of each year, and if it needs corrections later on, don’t worry. Your organization’s budget is free to evolve further into the year you get, so don’t feel like you have to remain rigid with your initial plan. Also, make sure your budget is approved by your board of directors when it’s written up. It’s important for your board to be aware of upcoming plans and initiatives, and they may need to approve increases to the budget. Engaging an independent certified public accountant (CPA) to conduct an external audit is crucial for nonprofits.

Should you hire or outsource for nonprofit accounting?

Nonprofit accounting standards – PwC

Nonprofit accounting standards.

Posted: Thu, 01 Jun 2023 10:53:24 GMT [source]

You can also leverage social media to build your brand and increase your visibility. The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business. First, nonprofit bookkeeping find out which considered software offers a free trial or a version you can use to try the software before buying. Understanding the key aspects of accounting will help your nonprofit better recognize the financial situation of your own organization. Does your nonprofit have a dedicated team member with both the skillset and capacity to handle your accounting needs?

CPE Webinar: Mastering Budgeting: Build Budget Reporting for…

Wajiha spearheads Monily as its Director and is a leader who excels in helping teams achieve excellence. She talks about business financial health, innovative accounting, and all things finances. Nonprofits should maintain complete and accurate financial records, including receipts, invoices, bank statements, and other supporting documents. These records should be organized systematically and easily accessible for audit and reporting purposes.

- Aside from these fundamental differences, there are several other characteristics worth mentioning.

- Many small to midsize organizations struggle to find someone to fill this role.

- This is a great business for a creative person with an eye for composition.

- Many nonprofits use fund accounting to track and report financial activities separately for different funds or programs.

- When planning your marketing strategy, it’s important to think about the message you want to send to prospective clients.

Key Responsibilities of a Nonprofit Bookkeeper

When we contacted a sales representative for a starting price, we were told there is no set starting price as each solution is uniquely catered to the NetSuite client. Our professional opinion is that the majority of nonprofits will benefit from outsourcing their bookkeeping and accounting needs, working directly with nonprofit accounting experts. It’s an affordable option that can provide access to deep nonprofit accounting experience and expertise. Not only is a financial audit NOT a bad thing, it can actually be a very good thing.

Customers report paying more than $600 a month for NonProfitPlus’s full suite of features, so if you’re looking for affordable nonprofit software, NonProfitPlus probably isn’t it. Next, make a list of the features your organization needs to properly track, report and manage its funds and taxes. Such features may include the ability to track and allocate https://www.bookstime.com/ restricted funds, process payroll and pull reports to aid you in filing your 990 form. Now, reference your list of considered providers and the plans you can afford. Find the provider and plan that most closely matches the list of features your organization needs. Xero’s highly customizable and in-depth reporting tools make Xero stand out.

Ask your bank whether they offer business chequing accounts tailored to nonprofits. Complying with the generally accepted accounting principles (GAAP) will ensure that your nonprofit reports financial information accurately, transparently, and consistently. We’ll help you modernize your nonprofit accounting & bookkeeping systems to get consistent and accurate reports. And we’ll show you how to use those reports to make smarter decisions for your organization. Nonprofit bookkeepers must create accurate invoices for vendor payments, retail sales if they have a store, membership subscriptions, tuition fees, and more. Once a year, you’ll send the required documents to an accountant to submit Form 990 to the IRS and provide tax documentation to staff.

- There are big companies that have thousands of products, such as Oberlo and Alibaba, that do this.

- When mapping out your process, it’s helpful to understand how accounting and bookkeeping work together and how they differ.

- Form 990 captures information from the four financial statements above, so maintaining accuracy will help you make tax season much smoother.

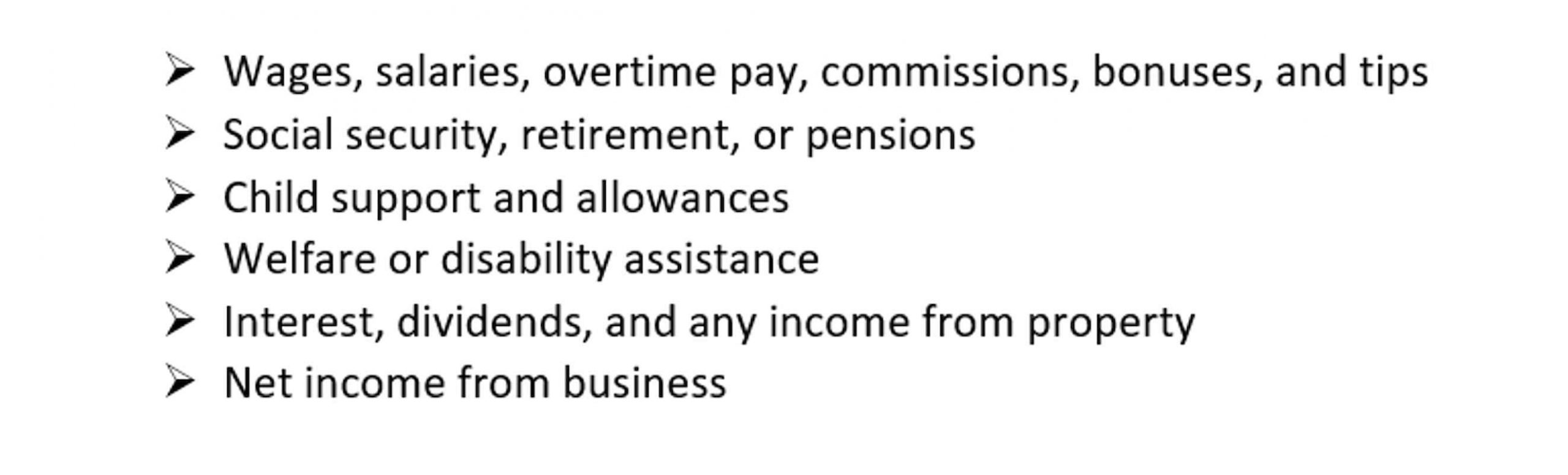

- Nonprofits rely on donations and grants from individuals, corporations, and other sources.

- A good budget can act like a roadmap for a nonprofit, determining where and when the organization will deploy its resources, and whether it’s on the right track financially.

But, when you grasp how to read various accounting documents, it becomes much easier to understand how finances function and move at your organization. Your nonprofit’s budget is the document that individuals at your organization are more likely to be familiar with. This document is created by your leadership or finance team using information from your development team and historic spending habits from your organization.

What Is Unearned Revenue, And Why Is it Good for Your Business?

There are no startup costs other than having a computer with a good internet connection. Many writers market their services on LinkedIn or in business social media groups. You can also reach out to the marketing director of businesses to offer your services. A dog walking business is an excellent opportunity for someone who loves dogs and is good with other people’s dogs. This business requires you to go to people’s homes to let their dogs out to play or go for a walk. You don’t need any special credentials to be a dog walker, and since you’ll be using your clients’ leashes, you don’t need to invest in much.